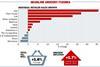

Asda only one of big four to grow share as Lidl achieves highest ever growth

Asda was again the only one of the big four grocers to grow its share in recent weeks, while Lidl achieved its highest ever growth.

Already have an account? Sign in here