With 80% of businesses identifying climate change as of high importance, Datamaran takes a look at how retailers are addressing these matters and what retail leaders should be aware of when it comes to ESG

A real-time review of the top retail companies shows that climate change risks are currently considered very important. The issue is mentioned in 82% of financial reports published by top global retailers and is also flagged in 95% of those retailers’ sustainability reports.

But on further investigation, only 24% of CEOs or c-suite executives felt it was important enough to address as an issue in their management letter or the management discussion and analysis (MD&A) section of their reports. What does that suggest about the authenticity or priority of this issue?

Analysing relevant disclosure information for retailers in the top 8,000 global companies by market capitalisation, via the Datamaran strategic ESG platform, identified the degree of importance they attribute to climate change risks and their management.

- High – 70%

- Medium – 16%

- Low – 2%

- Nothing – 12%

There is no doubt this is a critical issue for all retailers. The driver behind much of this activity is the short-term regulatory risk for climate change – the regulations companies must adhere to right now.

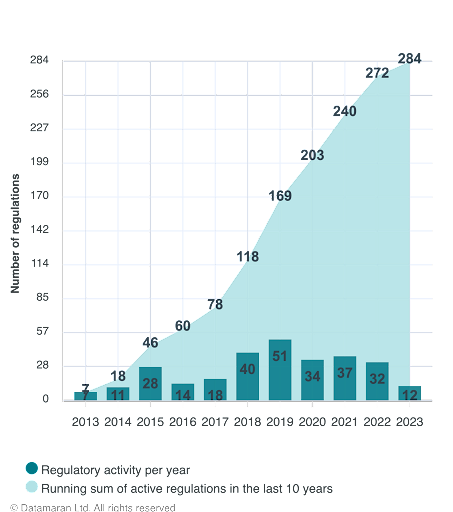

The number of active climate change regulations impacting retailers is high, with more being published every year. The introduction of the Corporate Sustainability Reporting Directive (CSRD) is the latest and most comprehensive to impact retailers.

While retail chiefs may currently have only limited knowledge of the constantly evolving ESG landscape, with direct management being delegated to ESG professionals, the new rules mean the responsibility for ESG rests firmly with them.

It is becoming increasingly important for business leaders to have a high-level overview of ESG and how it integrates into the overall business strategy.

A helpful first step would be to familiarise themselves with these widely used global reporting standards and frameworks:

- TCFD: The Task Force on Climate-related Financial Disclosures (TCFD) provides guidelines for financial disclosures related to climate topics, divided into governance, strategy, risk management and metrics/targets. TCFD reporting is mandated in many jurisdictions.

- CSRD: In 2022, the EU adopted the Corporate Sustainability Reporting Directive (CSRD). This requires around 50,000 EU-based companies to report sustainability and human capital metrics. Non-EU companies with a turnover of more than $160m in the EU are also subject to the directive.

- TNFD: The Taskforce on Nature-Related Financial Disclosures (TNFD) provides frameworks to help companies address nature-related risks and achieve nature-positive outcomes.

- SASB: The Sustainability Accounting Standards Board (SASB) provides sector-specific standards for sustainability reporting. It includes energy management in retail distribution for multichannel and speciality retailers, and employee recruitment, inclusion and performance metrics for ecommerce operations.

With ESG’s legislative landscape constantly evolving, staying ahead of the latest requirements efficiently and effectively is increasingly difficult.

Identifying and monitoring material ESG risks and opportunities is now a key element in any retailer’s business strategy.