Matt Henderson (Rangespan)

Matt is a co-founder and director of the ecommerce technology company Rangespan, which provides supplier management and market data systems to retailers such as Tesco, Argos and ASDA.

Matt previously worked at Amazon.com for 7 years, most recently as UK Director of Merchant Services, where he led the third party marketplace business and the WebStore software business. In prior Amazon roles Matt was a category director and led a variety of functional teams. His first retail jobs were on the shop floors of independent sports and fashion retailers.

Matt has an MBA from London Business School and a BA from the University of Otago and was a visiting scholar in technology management at MIT.

42 comments By Matt Henderson (Rangespan)

I love Ikea but... to double market share by 2020 their sales growth would have to average about 12% for the next 7 years, a big uplift from the current rate of 3.1%. Seems like a bigger transformation would be needed.

Regarding the line "led by co-founder Andrew Curran", I thought David Worby was still CEO, has he left already?

If anyone is interested to learn more about the methodology, I'm happy to take questions at matt@rangespan.com

Good topic, but it seems odd that there are neither examples nor facts given in this article... Sam, what is it that led you to conclude that investors were not as discerning in the past as they are now?

Retailers' predictive analytics has historically (and in all the examples in this article) been focused on using internal data.

At Rangespan, however, we track and rank more than 200 million branded non-food products based on a prediction of how each will sell one month in the future.

Retailers can use these predictions to understand more about the product they do not already offer, including which they should not waste time/resource on, and which are most likely to sell well.I'm all for extra competition in the digital music space, but I don't think image recognition is a compelling differentiation. In the time it takes me to take a photo and upload it to the app, I could just type the album or band name.

Also, this level of image recognition is now pretty generic, widely available technology. That iTunes and Amazon don't already use it to for album search is a good hint that customers are unlikely to care.HTC doesn't have a large cash balance, and it's phones are technical good but suffer from poor brand awareness.... it would be an interesting acquisition target for Amazon.

I don't think it is a High St saviour, but I do think the deal was a good one for Argos.

In the long term, for offline collection points, it is hard to see how staff-operated stores can compete economically with lockers or densely packed drive-through locations. The ratio of cubic space to product throughput isn't as competitive.

If you are pre-committed to stores on long leases, however (which Argos are) utilising them for additional activity during that term makes sense.Catering for an average of 24mins doesn't make much sense if the standard deviation is high. For example, if 50% of customers spend 5 mins and 50% spend 43 mins, the average is still 24mins, yet the store and staff should try to cater to quick visitors as well as slow browsers. My point isn't to be mathematically pedantic - store traffic does tend to polarise between different segments like that.

Great, already signed up. Those green trucks will be bringing fresh tiger bread up my driveway so often ASDA may find my monthly 5 quid will be deeply unprofitable...

Nice idea for slides, would be curious to see more. The Tech Crunch blog does a regular series called TC Cribs (i.e. play on the MTV show). Sadly some retail offices don't make for pretty views. At Amazon in Slough the toilets always used to get blocked up in some horrifying ways....

They haven't lapped the Comet shutdown yet, so that should still be contributing several % to year-over-year growth....

High Streets aren't dying they are just evolving. Flourishing High Streets are more about an evolution of the category mix and supply chain than the design of the environment. Vertically integrated fashion brands aren't affected as much by online price competition, so they are increasing as a proportion of High St store mix. Cafes and restaurants are also increasing. As are manufacturer-owned or controlled showrooms. The increased mix of these three areas isn't because of store design, but the type of product/service they sell.

For the trailing 6 months, am a little surprised their online growth was not higher than that. For home and fashion categories the online market as a whole almost certainly grew 17%, possibly higher, i.e. so over the past 6 months John Lewis didn’t gain online channel share. (They obviously gained a lot of offline share though.)

I hope they experiment with it again in the future. Public opinion to use of behavioural data change quite quickly over time and I don't think it will be long before an overwhelming majority of customers will be happy with this as long as (a) it is clear how it will improve their own shopping experience, (b) the retailer is very transparent about usage and limits and (c) it is very easy to opt out. Twelve years ago quite a few people felt uncomfortable about Amazon product recommendations, and now the same people get grumpy that other retailers don't have more personalisation.

This may also have been influenced by the NSA Prism scandal creating a period of increased sensitivity around personal data in the US.Couple of extra things to note:

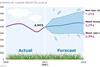

That slow international growth of 13% is after negative exchange rate effects converting to US$. Though international did decelerate.

Their gross margins actually grew a lot (perhaps related to deceleration). The loss was almost entirely caused by a huge increase in technology spending (probably mostly on the AWS and digital). They are staffing up like crazy.Mintel's forecast has a 90% spread between the worst case and the best case scenario. That isn't so much hedging their bets as saying they have no idea...

It was an interesting risk to take, and though it didn't work out it's hard to criticise Robertson's judgement when he has clearly got so many other things right. And you can't blame the headhunters, they do what they do, caveat emptor.

If the goal was sourcing knowledge, I wonder if that is not better found a level or two lower, fresh from offshore roles. Or maybe Li & Fung. People at Bostock's level at companies like M&S are statesman-like, often a long way from the scrappy details that I suspect ASOS likes to operate at.I'd love to see how the unit economics of this compare to their other delivery options. One of the challenges with narrow window same day or next day services is that 100% of customers say they'd like it, but unless you subsidise it (i.e. make a loss on it, and HoF probably is at £6) less than 20% of customers are actually willing to pay for it.

Great business, and at £300m it is probably undervalued - seems like their bankers are low balling it. If they grew 83% YoY in 2012 (from 151m to 275m) they must be having another stonking year after Comet's fall. A £300m valuation would probably only be 0.7-0.8 times the annual sales runrate at time of IPO, and even for a category with low long term operating margin prospects (perhaps 2%) that feels like a bargain. Put another way, it would be about the same price/earnings multiple as ASOS, but growing at twice the speed.

Commented on: 22 November 2013

Ikea plans to double market share by 2020 as sales rise 3.1%