PROMOTIONAL RESEARCH

Exclusive consumer research by Retail Week reveals that shoppers plan to rein in their spending in the next 12 months as they reconsider their purchasing habits in the wake of the global pandemic.

More than half (55%) of consumers say they will reduce their spending over the next year, according to exclusive insight from 1,000 consumers uncovered in our new report How They’ll Spend It, produced in association with Openpay.

Spending in discretionary categories looks set to remain under particular pressure, especially when it comes to clothing and accessories.

Just 37% of shoppers expect to continue to shop as they did before

Only 9% of consumers expect to spend more on fashion in the next 12 months than they did before the pandemic, compared with 42% who said that they would spend less, according to our survey conducted in May.

Just 37% of consumers said they expected to continue shopping and spending just as they had before the crisis.

Encouragingly, 53% of consumers said they had missed shopping during lockdown, citing the social aspects and browsing as aspects they missed the most, as well as specific retailers such as Primark.

Young consumers aged 18 to 24 were the most likely to rush back into stores as they reopen, the report found.

However, despite looking forward to stores reopening, 60% of shoppers said that they needed to be very careful about how they spend money in the coming months.

The most squeezed shoppers were those in the 25 to 34 age group, with 37% now earning less as the result of reduced income and furlough schemes.

53% of consumers said they had missed shopping during lockdown

In essential categories such as grocery, spending remains a priority, although habits have changed.

Across all age groups, 47% of shoppers spent more on groceries, but 55% said they had shopped less often for them during lockdown, and many expect these new habits to continue.

For instance, 25% of shoppers had discovered new local food suppliers and 37% expected to shop more within their local communities.

Online shopping appears to have reached a tipping point, with customers across all categories and age groups increasing their ecommerce spend.

In grocery, 48% shopped more online during the pandemic, with 36% expecting to continue to do so.

Spending influences

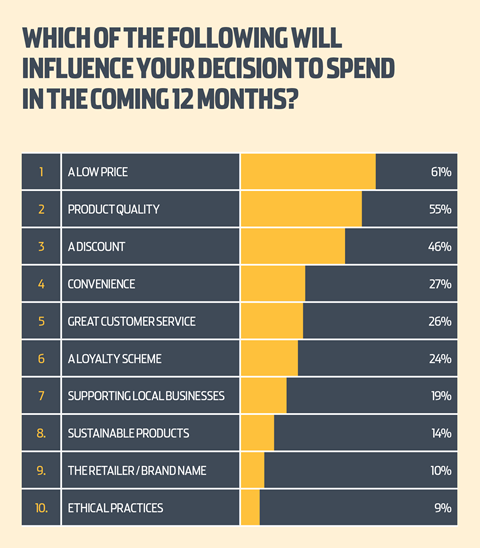

We asked shoppers which factors would influence their decision to spend in the coming 12 months.

Price was the biggest influencer for squeezed shoppers, but they also expect value for money.

Sustainability and ethical practices resonated too, particularly with shoppers under 35.

A major change post-Covid-19 is in the way that shoppers expect to pay for items purchased. There is a clear increase in demand for digital and alternative payments.

Only 27% of consumers now expect to pay using cash when shopping in-store, compared with 63% before the pandemic. This has been supported by retailers actively encouraging shoppers to use contactless payments.

To access our full report, How They’ll Spend It, including in-depth analysis by category and demographics, click here.