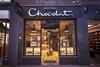

Hotel Chocolat profits and revenue fall as international sales suffer

Hotel Chocolat has posted a fall in profits and revenue in its first half as strong UK sales were offset by plummeting international sales.

The upmarket chocolatier reported EBITDA of £22m for the 26 weeks to December 25, 2022, down from £33.8m, as well as a profit before tax more than halving to £10.2m for the period, down from £25.4m the previous year.

Already have an account? Sign in here