UK households are going to experience three distinct Christmases this festive period – Mail Metro Media’s insight director Luke Hand is here to explain just what that means for consumers and retailers

The UK is officially out of recession. Household financial confidence and wages are rising. Inflation has fallen and further interest rate cuts are expected to follow. We even have some semblance of political stability.

All of these positive indicators must point towards a return to the heady, high-spending days of Christmas past, right? Well, the answer is not that simple. Our data shows an uneven recovery from Covid-19 and the cost-of-living crisis. This increasing fragmentation will lead to three very different Christmas experiences for UK households.

With the emergence of a ‘three-speed UK’, some households will see a return to the indulgence of Christmases past and will be going all out, while others will struggle to celebrate the festive season while still trying to make ends meet. The majority of Brits will fall somewhere in the middle – striving for their first ‘normal’ Christmas since 2019.

The three Christmases

The type of Christmas experience you have – and how excited you are – is very likely to depend on the means of your household.

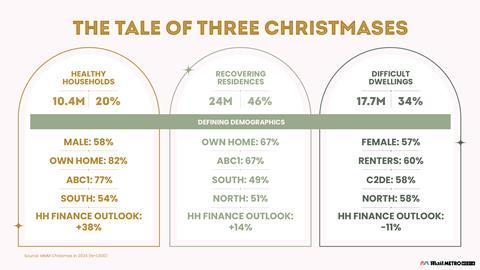

Healthy Households (20% of the UK population) are likely to have a Christmas that closely resembles the pre-Covid years. Recovering Residences will also experience a relatively normal Christmas, albeit with some cutbacks. Difficult Dwellings (34% of the UK population) are likely to still be feeling the pinch of the cost-of-living crisis too deeply to have a ‘normal’ Christmas.

Christmas trends uncovered

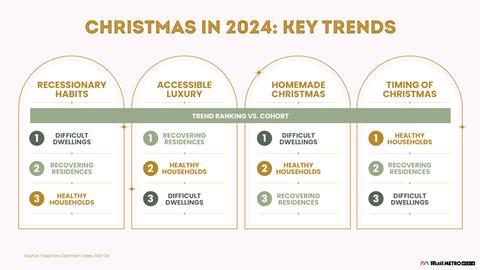

Recessionary habits – 63% agree ‘you can still get sales prices if you shop around’

Many consumers are still in a recessionary mindset, showing little change from the cost-saving behaviours taken up during the cost-of-living crisis. These include cutting back on non-essential spending, loyalty card usage, shopping around for better deals and switching to own-brand products. All cohorts will be affected by this trend, but those who are struggling financially will be impacted most.

Accessible luxury − 55% agree ‘it’s important to indulge yourself at Christmas’

Own-brand products have been growing in popularity – including in the luxury space. From bargain to midmarket and high-end, many are developing or enhancing their own-label ranges in categories that conventionally would be the domain of premium brand owners such as perfume and spirits. Brands will have to stand out through image and pricing to compete. This trend is most relevant to Recovering Residences – who are hoping for a normal Christmas.

The timing of Christmas - 12% net increase in those planning more time off work

Christmas will fall on a Wednesday this year with the school holidays starting the Friday before. This timing should provide more opportunities for shopping, leisure and travel. Consumers may hit the shops harder than in the last two years (Christmas was on a Sunday in 2022 and a Monday in 2023) as there will be a full weekend and two days off before Christmas, leaving plenty of time for last-minute shopping.

Homemade Christmas – 33% say ‘I like to make presents to give to others at Christmas’

Making gifts, decorations, food and drinks at home has also been growing in popularity. Primarily driven by the need to cut costs, this trend will be most prevalent for the poorest households. That said, we also expect a rise in DIY Christmas elements across average and high-income households, which could be driven either by an increase in the importance of sustainability or simply the desire to show off knowledge and skills.

Summary

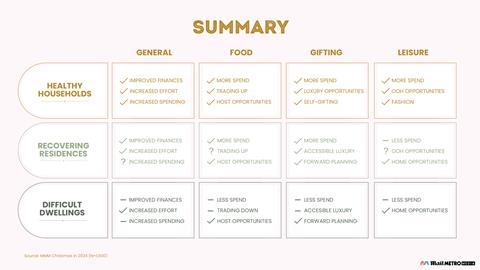

In the lead-up to this year’s festive season, it will be essential for retailers, supermarkets and brands to understand the different circumstances of the three main groups of consumers, making sure to tailor goods and experiences to their unique Christmas experiences.

There will be so much variation in the way households prepare for Christmas that a singular message from advertisers is unlikely to penetrate the whole market – adaption will be vital for retailers who want to attract spending from all three of our groups, as will timing.

To find out the optimum time to reach the audience for maximum impact, as well as get specific insights on consumer attitudes around food and drink and gifting, download the full research deck.

Luke Hand is insights director at Mail Metro Media. Email him at luke.hand@mailmetromedia.co.uk