Retailers opened the lowest number of new stores for five years in the first half of 2016, but shuttered 15 shops every day.

During the first six months of the year, just 2,153 new stores opened in the UK – the lowest first-half total since 2011, when 1,809 shops launched.

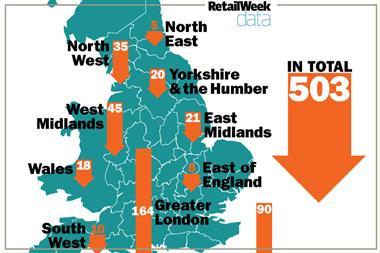

According to PwC research compiled by Local Data Company (LDC) 2,656 shops closed during the same period, creating a net decrease of 503 stores across high streets, retail parks and shopping centres.

The figure represents the highest net decline in shops since the first half of 2012, when 953 more stores closed than opened.

Fashion businesses suffered the steepest net decline in store numbers between January and June, with 87 net fewer stores.

Clothing retailers opened 119 stores during the period but closed 206, the PwC LDC data said.

Jewellers, tobacconists and health clubs were among the sectors that grew at the fastest rate during the first half of 2016, while takeaway food shops and American, Italian and Japanese restaurants also thrived.

Highest net increase in openings by business type in H12016

| Net change (Units) | Number of openings | Number of closures | |

|---|---|---|---|

| Tobacconists | 28 | 60 | 32 |

| Estate agents | 26 | 102 | 76 |

| Jewellers | 24 | 62 | 38 |

| Takeaway food shops | 19 | 48 | 29 |

| Restaurant – American | 15 | 18 | 3 |

| Health clubs | 14 | 39 | 25 |

| Coffee shops | 14 | 73 | 59 |

Highest net decline in openings by business type in H12016

| Net change (Units) | Number of openings | Number of closures | |

|---|---|---|---|

| Fashion shops | -87 | 119 | 206 |

| Banks & other financial institutions | -82 | 20 | 102 |

| Clothes – women | -56 | 17 | 73 |

| Mobile phones | -46 | 48 | 94 |

| Recruitment agencies | -46 | 29 | 75 |

| Clothes – men | -39 | 15 | 54 |

| Cheque cashing | -35 | 6 | 41 |

Online impact

Retail parks were the only location type to see growth in the number of occupiers, although their activity levels were lower than both high streets and shopping centres.

Shopping centres suffered the highest percentage net loss, with the number of trading stores falling 1% compared with the first half of 2015.

The analysis of 66,401 outlets in 500 town centres across the UK found that the overall number of openings and closures have plummeted from a record 7,749 in the first half of 2010 to just 4,809 during the first half of this year.

LDC said the advance of online shopping was “a contributing factor”, which has prompted “an overhaul of retail store strategies” from many businesses.

The rise of ecommerce and multichannel shopping has sparked the launch of 22,200 click-and-collect services across the UK.

Between 2015 and 2016, Carphone Warehouse grew its click-and-collect footprint the most after launching the service in 129 locations, LDC said.

Screwfix, Toolstation and LloydsPharmacy rolled out click-and-collect in 58, 36 and 33 locations respectively, the data said.

Restructuring store portfolios

PwC insolvency partner Mike Jervis said: “We are seeing far fewer closures due to outright insolvencies, but more due to lower key restructuring of store portfolios.

“This is still having a negative impact, particularly on the high street – interestingly, units on retail parks are far easier to find alternative tenants for.”

Jervis added there has been “more evidence of stress” during the second half of the year, as retailers grapple with additional pressures including the national living wage, the fall in the value of the pound and the business rates revaluation.

LDC director Matthew Hopkinson said: “The role of the store continues to evolve. Provision of a seamless on and offline experience is key. Click-and-collect is but one example of this.

“Chains are having to work harder than ever to guarantee store location, format and experience along with a strong web presence, social presence and logistical operation that delivers to consumers’ ever-increasing demands of ‘now’.

“This is severely impacting profitability and hastens store closures.”

No comments yet