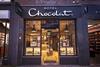

Hotel Chocolat opens new credit line as Easter sales hit by lockdown

Hotel Chocolat has opened a new line of credit with its bankers following a subdued Easter sales period due to the coronavirus lockdown measures.

In an update to the City today, the chocolate specialist said it had increased its banking facilities by opening a new £35m line of credit with Lloyds Bank, which replaced its existing £10m overdraft facility.

It said that the new credit, on top of the £22m of investment it recently raised from investors, would “fund growth capital investment and provide operational headroom” for the business.

The new credit facility is comprised of two separate tranches, with the first £25m expiring in December 2021 and provided under the terms of the government’s coronavirus large business interruption loans scheme and a £10m facility provided by its bank under normal commercial terms, which will run until the end of this year.

Already have an account? Sign in here