A lack of new store locations is the only hurdle to Primark’s domination of Europe, according to finance director of its parent firm Associated British Foods.

John Bason told Retail Week: “In our existing European markets we’ve got it right. We have the capability, we just need the right stores.”

Bason said its pipeline was “very bare” in its 2015 financial year because of a lack of availability of stores. It plans to open less than 1 million sq ft of new space in 2015, less than in its current year.

Bason said he was eager to expand its French business after strong trading in the country where it has opened five stores since its debut last December.

“It’s not a matter of trialing it [in France], it’s just the availability of property to roll out,” he said. “We don’t want to grab space, we want stores with good footfall in the right location.”

The retailer is looking for large stores in high footfall locations to enable to show off its range fully. He said in larger cities stores could reach up to 180,000 sq ft while in smaller cities, such as Cambridge, 45,000 sq ft was an ideal size.

Primark is also eyeing further growth in Spain, where it overtook Zara to become the biggest clothing brand by volume earlier this year.

Bason said sales in Spain, where it has 40 stores, were “unbelievable” and like-for-likes surged over 10% in its current year to September 13.

“What that’s saying to me is that people are still connecting with Primark in Spain,” he said.

Bason said it would not have as many stores in Spain as in the UK but “there’s still some way to go”.

He revealed it had signed for a 100,000 sq ft flagship in Madrid which will open towards the end of 2015.

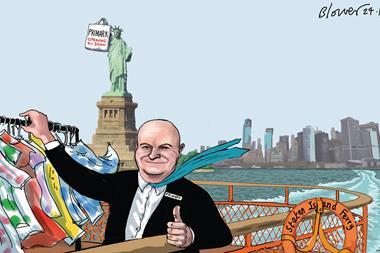

Meanwhile Primark, which will open its first US store in Boston in late 2015, said negotiations are underway to secure further stores in the north east of the country.

It intends to trade up to ten stores by late 2016 and plans to lease a warehouse in the region.

Bason said it was looking for mall locations in Massachusetts, around the Philadelphia area in Pennsylvania, Baltimore, Washington and New Jersey. He said it was not looking at Manhattan in New York “at this stage”.

Despite, it’s surging popularity in Europe, Primark is expecting lower sales densities in the US.

“The awareness of the consumer is a lot lower than in Europe. In France, they’re just waiting for us to open in their locality. It’s not the same in the US, so we are tempering our expectations,” he said.

Primark’s sales are expected to surge 17% and like-for-likes 4.5% in the year to September 13. Bason applauded its buying team who he said had “nailed” its product offer and helped reduce markdown.

He also said that the UK consumer is feeling the benefit of improving economic conditions which ahd led to a slight increase in sales volumes and value per visit.

No comments yet