How knowing your 'place' can help retailers to tailor their offers to different local catchments.

The old adage of 'build it and they will come' is based on a historic retail landscape before the emergence of the internet, when the only choice for retailers to gain market share was to add more stores.

Clearly the sector has evolved, and for many retail locations it’s now a case of finessing rather than creating.

But how can places be changed to ensure that consumers are able to benefit from a best-in-class shopping experience?

“The key for retailers is to recognise, understand and appreciate these differences in ‘place’”

While it may seem like a nebulous term, 'place' in fact encapsulates hugely complex and diverse trading environments.

Inevitably the usage of each place varies, and so an understanding of this variance is critical to maximising a retail offer, and therefore a retailers’ trading potential.

The four town centre types

Springboard led a two-year, £1m project backed by national funding agency Innovate, which formed part of its 'Improving the Customer Experience' work stream.

Working with Manchester Metropolitan and Cardiff universities, Springboard’s database of footfall derived from over 4,000 counters located across 200 high streets was analysed to understand – for the first time – how town centres are actually used.

And the results were enlightening.

The data found that there are four clear types of town centre: comparison, multifunctional, speciality and holiday.

Comparison

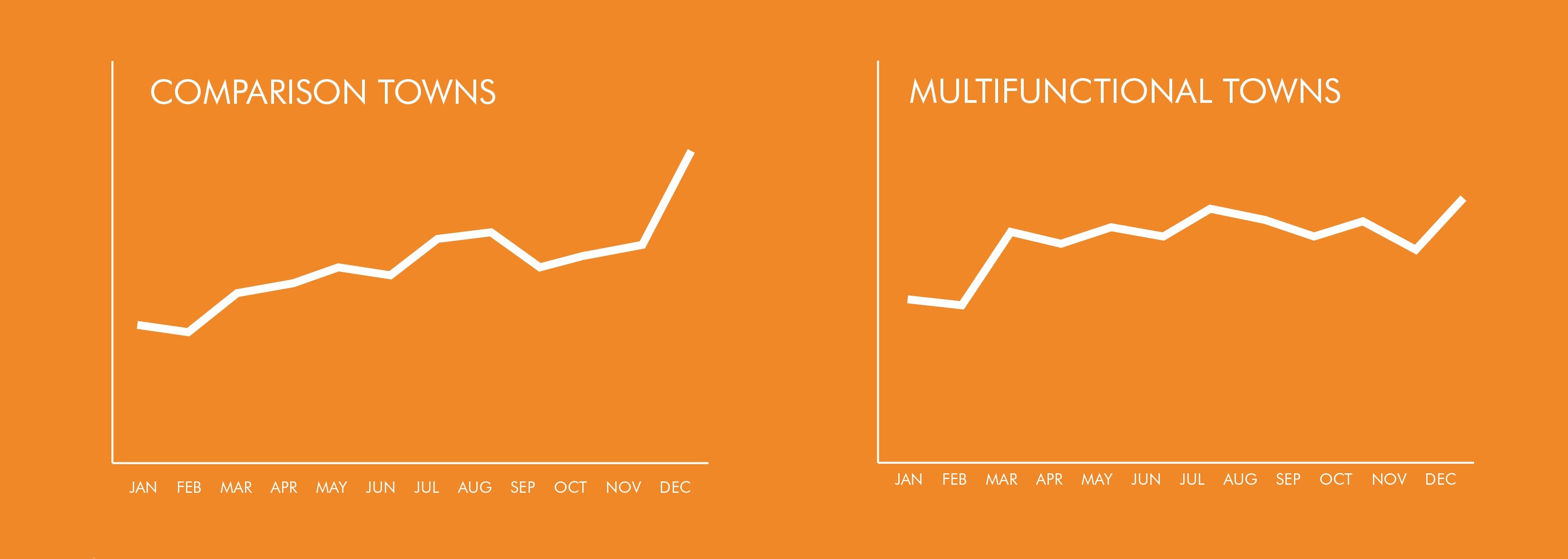

Only 25% of all town centres are what we would regard as conventional retail centres, being categorised as ‘comparison’ towns.

These towns, which include Cardiff and Liverpool, have a focus on retail, comprising a strong retail anchor with peak footfall at Christmas.

The other three categories have additional, complementary elements that mean that retail forms part – but not all – of their offer, resulting in a very different pattern of usage by consumers.

Multifunctional

Around 50% of towns are categorised as ‘multifunctional’, such as Croydon and Aberdeen.

While often having a wide retail offer, multifunctional towns are visited for a range of purposes including work and leisure.

Footfall in these towns is relatively stable throughout the year, with a much smaller uplift at Christmas than that of comparison towns.

Speciality

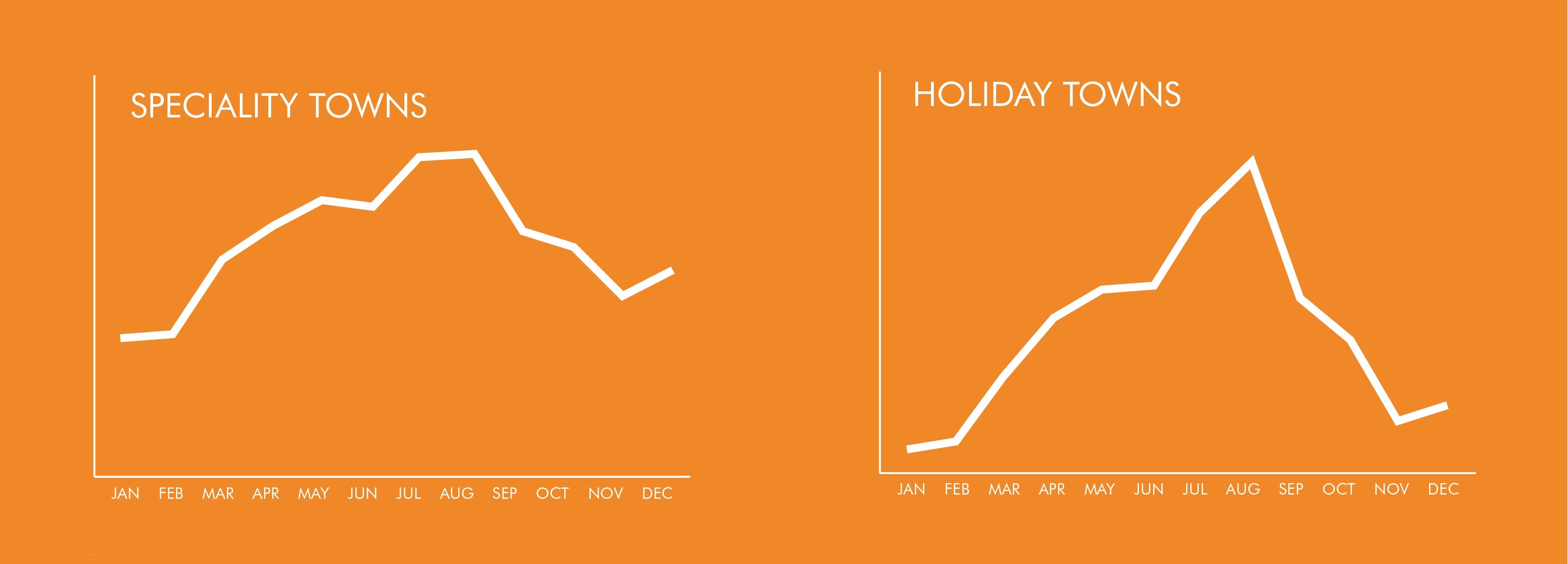

‘Speciality’ towns – including Bournemouth and Rotherham – account for a further 24% of all footfall.

While often having a strong retail offer, the heritage or character of the town delivers a uniqueness of place that means footfall peaks are seen in the summer months with a further, but much smaller, uptick at Christmas.

Holiday

The fourth category is holiday towns, where footfall peaks sharply in August, and Christmas does not feature; Blackpool and Weston-super-Mare are quintessential holiday towns.

By focusing on delivering experiences to tourists, holiday towns may actually serve their local catchments quite poorly.

The key for retailers is to recognise, understand and appreciate these differences in ‘place’.

By correlating the trading performance of individual stores to the relevant town category, it is possible to better understand and explain current trading performance, using that insight to plan and deliver a proposition appropriate for each specific town, or even reconfigure the store network to futureproof overall brand performance.

Diane Wehrle is marketing and insights director at Springboard

To find out more visit spring-board.info

No comments yet